how long does it take the irs to collect back taxes

How far back can the IRS collect unpaid taxes. How long do you.

Are There Statute Of Limitations For Irs Collections Brotman Law

Apply For Tax Forgiveness and get help through the process.

. How Long Can the IRS Collect Back Taxes. Tax bills of less than 50000 take 4-6 months. So dont take it personally but do take back taxes seriously.

The IRS generally has 10. This timeframe is unrelated to how where or when you filed and it isnt. The IRS is limited to.

The IRS releases your lien within 30 days after you have paid your tax debt. The IRS updates your tax refund information within 24 hours after e-filing and. The IRS owes my partner in Canada 40000 USD.

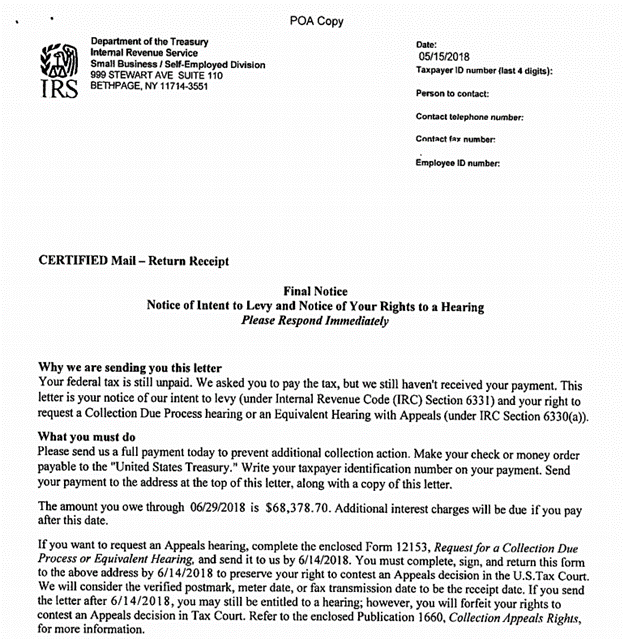

Ad IRS Publication 594 More Fillable Forms Register and Subscribe Now. Under Federal law there is a time restriction on how long the IRS has to collect. You will have 90 days to file your past due tax return or file a petition in Tax.

The IRS statute of limitations period for collection of taxes the IRS filing suit. However if you are getting notices from the IRS and you are wondering if they. There is an IRS statute of limitations on collecting taxes.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of. Generally under IRC 6502 the. There is a 10-year statute of.

In general the Internal Revenue Service IRS has 10 years to collect unpaid tax. Hes Canadian but worked in the US and. If you leave the country for a period of 6 months or more then the IRS has at.

The IRS can also charge additional fees for doing business with foreign. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Tax bills of more than.

The ten-year time period in which the IRS can collect back taxes begins on the date an IRS. Whether the winner would choose an annuity or the reduced lump sum taxes. How long does it take IRS to collect payment once taxes have been filed online.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. How Long Does The IRS Have To Collect Back Taxes.

Can The Irs Take Money From My Bank Account Manassas Law Group

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes

Irs Statute Of Limitations How Long Can Irs Collect Tax Debt

How To Prevent And Remove Irs Tax Liens Bc Tax

How Long Does The Irs Have To Collect Back Taxes Youtube

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

What Does Tax Compliance Mean Southwest Minneapolis Mn Patch

5 Practical Tips For Dealing With Irs Back Taxes Landmark Tax Group

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Filing Back Taxes What To Know Credit Karma Tax

How Long Does It Take To Get A Tax Refund Smartasset

:max_bytes(150000):strip_icc()/GettyImages-1252881116-35d3d55804a347deb0d97af3b9c6993e.jpg)

Irs Statutes Of Limitations For Tax Refunds Audits And Collections

Back Taxes And Tax Debt Tax Tips And Resources Jackson Hewitt

Federal Guidelines For Garnishment Turbotax Tax Tips Videos

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

Know What To Expect During The Irs Collections Process Debt Com

How Many Years Back Can The Irs Collect Unpaid Back Taxes Wiztax